With all due respect, using that logic… we should still treat all heart disease with open heart surgery. Even though it was more invasive to the body… it was likely “cheaper” and “simpler”. No need for any fancy stents or less invasive “computer” procedures. Just bring out the bone saw, boys…

Fail to see the point. Open heart surgery was never cheaper or safer. Breaking the rib cage to get at the critical part was traumatic and a last resort. Pace makers, stents, and non invasive procedures were much cheaper and safer.

Multiple sensors and computers are necessary for getting the most efficiency out of mechanical devices, but when they fail you can be left on the side of the road. A reasonable trade off. As sowell says there are no solutions, just trade offs.

Yup!

Circa 1958, the doctors were “stumped” by my aunt’s condition, and they narrowed it down to “either heart disease or cancer”. Huh? They narrowed it down to totally-different diseases. Their only diagnostic solution was to open up her chest and abdomen in order to do “exploratory surgery”.

Thankfully, despite the inherent risks with that type of extreme surgery, she survived the procedure and they found out that she had an “inverted heart”. Even with the relatively crude treatments for heart problems in those days, she managed to survive for another 6 years or so.

The Good Old Days… when modern medical technology and non-invasive diagnostic tests were unknown, they had to resort to opening up one’s body in order to do a visual check. She survived that surgery, but not everyone was that lucky in those days.

This is absolutely correct. Most on here fo not like these fars because thry do nog have 300 horsepower or whiz bang gadgetry but those cars especially the old cavaliers would run on hope and a prayer, not running because of how thry were maintained but in spite of how they were maintained.

These new economy cars with turbos and cvts will NEVER last as long as the economy cars from the 70s- early 00s

Yep, I see Cavaliers all over the place, the high point of reliable high quality transportation ![]()

@old_mopar_guy unless you are so poor that your budget, after rent, food, utilities, and clothing leaves you nothing. So you finance a car (because you have no options) and you fail to check the insurance cost or factor in maintenance costs and end up in dire straits. Welcome to being truly poor.

You haven’t a clue.

Numbers don’t lie.

Get real, @Old-Days-Rick

I haven’t seen a Cavalier on the road in YEARS

… or a Beretta, or a Tempo, or anything else from that era, except for the occasional exotic/collector car.

Then you work a second job to avoid being “truly poor” and you don’t consume alcohol or tobacco, and you don’t buy the newest Iphone, etc.

+1

When I worked at my last job, post retirement from the education field, the younger workers (that was EVERYONE, in comparison to me ![]() ) used to spend $8-10 every day for a take-out restaurant lunch, and if they had it delivered, then tipping added to that cost. Add-in the fancy coffee in the AM and the PM, and they were spending at least $65-70 per week for their weekday food and beverages.

) used to spend $8-10 every day for a take-out restaurant lunch, and if they had it delivered, then tipping added to that cost. Add-in the fancy coffee in the AM and the PM, and they were spending at least $65-70 per week for their weekday food and beverages.

I brown-bagged my lunch and I brought a thermos of coffee, with my total cost each week being far less than 1/2 of what they were spending. When some of them complained about not being able to save much money, I would suggest that they do the same as I did, and the response was usually something along the lines of… I don’t have time for that stuff before I come to work.

![]()

Naturally, they all had the latest iPhone.

They also took the elevator, while “the old guy” used the stairs, and–trust me–a lot of them would have benefitted from walking the stairs.

That seems like a tired trope, similar to the “welfare queen”. Despite your (and others) anecdotal evidence that poor people all fritter their money away, I know several poor people who have done nothing of the sort. They have had hard life circumstances such as being married to someone who turned out to be an alcoholic and abusive and left them with four young children and no income.

I myself went through a traumatic divorce with four children that left me with crippling child support. Despite my frugality (I did not consume tobacco, alcohol, or other recreational drugs, and I only carried the phone my job gave me) and working a second job as a volleyball referee while living in the cheapest housing available in the school district in which I was required to stay, packing lunches to work, and preparing meals at home every night, I fell deeply into debt. I guess you will find some other fault I must have borne, but I guess it seems easy to judge people when you haven’t had to walk a mile in their shoes.

When times improved for me through hard work and some good fortune, mixed with a dose of white privilege, I pulled out of all that debt and have done just fine. Not all are so fortunate.

Yes, there is no “one size fits all” when it comes to being in poverty or even being in compromised financial circumstances. There are many different scenarios–including crippling debt as a result of medical expenses.

Let’s not forget that The USA is the only developed nation where so many people go bankrupt as a result of medical debt, that at least 40% of the annual bankruptcies in The US are the result of medical debt.

Yup we are so judgmental sometimes. If you get in trouble and run th3 numbers on the actual net of a second job, ya sometimes find out that is no solution. After tax if you already have a decent income.

Only time I wouldn’t bring my lunch was if we were having some meeting and lunch was provided (usually pizza).

I did too, but the company paid for mine.

I golf a lot and 99% of the time I’m walking. Very few of 20yo thru 40yo walk. I’m amazed how some of them can swing the club around their 60"+ gut. It’s NOT pretty to watch.

Crushing medical debt? Like why college tuition skyrocketed. My bill for one week in the hospital was $850 and I could pay over one year at no interest. Sure I had insurance but not real good due to my work versus home location. The way the contract was written. Never been any free ride. If someone doesn’t pay, someone else does.

Nowadays, many hospitals will turn things over to a collection agency after less than 1 year. The result is bankruptcy for a significant portion of the population.

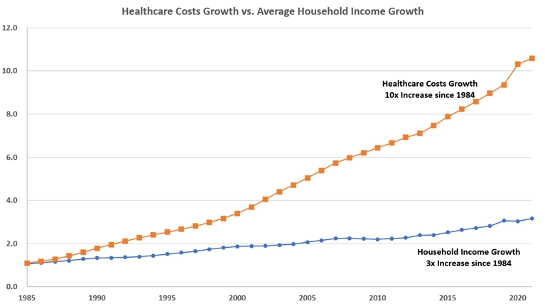

Over the past 4 decades, income in The US has grown threefold, while the cost of healthcare has grown tenfold.

I think a copay of $850 for a week in a hospital indicates pretty decent insurance.

Univ of mn raised tuition. It’s more expensive to get a degree that may get you a job in that field.